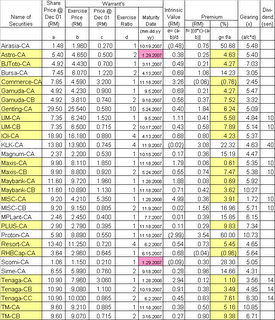

Investment Diary and Call warrant update 1/12/2006

You can see on the table that average premium on Call warrant is reducing or exhausting, this due to buyer already alert the risk of premium involving in CA, Only invest those blue chip that you think that still under pricing or potential to move on. Just remind that CA is not tradisional type of warrant, the expiry date is short. Avoid those seriously out of money and expiry soon. If buy Scomi Ca, you rather go for Gamuda WB which expiry soon and get the convertion discounts as yesterday price 4.21+ 0.47 =4.68 and mother at 4.92

Still think that Maxis Ca, Maybank Ca , Commerce Ca is top pick due to lower premium. and potentially, especially Commerce assets, if plan for merging goverment link plantation success, believe it will lift to another high. invest on your own risk, this just my 2 cent opinion. Although I have handsome gain on Maxis CA and RUB recently. I believe Bursa will continous lift up more potential counter.

As my previous post on top pick on mesdaq, i wonder why quality mesdaq and some quality 3rdlinear counter still not in play. But I believe soon will lift up too.

0 Comments:

Post a Comment

<< Home